Controllers are central to motion control systems. They’re often referred to as the brains of the system, evaluating feedback from the environment and responding in accordance with a control program to complete an assigned task.

Today’s controllers have more built-in functions, are more powerful, and are being used in diverse applications. We asked some of the top controls manufacturers what trends they’re seeing in the industry. Below are their responses.

Where do controllers of automation see new uses? Where do PLCs endure and where are they yielding to PLC functions onboard other controller options?

Christian Fritz, Head of Business Development, maxon

We see a continued trend towards the distribution of control functionality. Driven by the miniaturization of embedded control hardware, networking technologies and protocols, system integrators are building highly modular mechatronic systems, that consist of intelligent subsystems. These systems do not replace the PLC or main control system but provide autonomous operation and decision making and simplify the high-level control application. The result are systems that are more flexible (customer variations), easier to maintain (uptime) and allow for local decision making (increased performance).

Michael Burgert, Product Manager, Dunkermotoren

“PLCs are the masterminds for all processes in machinery and equipment. They know and control every process detail.” This used to be the common understanding ever since PLCs ascended the throne of all process and automation equipment. And it made sense because processor costs were high and distributed intelligence would have cost far more than centralized processing power.

Today, PLCs are no longer on the throne; there is no more throne. Hierarchies are about to dissolve and decentralized intelligence has already taken over many fields, which makes sense. With smaller and inexpensive processing power, even sensors can analyze themselves and generate warnings if they consider their signal levels poor. Integrated motors cannot only analyze their condition and forward this information but they can autonomously execute tasks and even control other motors or sensors. Every motor can be perfectly adapted to its task and communicate with all surrounding devices and with PLCs, if necessary. In many cases, PLCs are not necessary because decentralized intelligence can handle all the tasks of machinery and equipment. Imagine a packaging machine. Every station: material transport, goods transport, cutting and welding can be handled as autonomous tasks. Each station communicates with the other stations about status, condition and possible errors.

Of course, PLCs will not vanish completely. There will always be tasks that are extremely complex and need a lot of processing power. But these PLCs will be on the same level as all other devices. Within the network, PLCs will more be the “pal that does the complex computing” instead of Mister Know-it-all.

This cutaway view shows maxon’s EPOS2 70/10 controller, featuring dual-loop positioning and speed control.

In what industries or application areas has your company seen increased activity or demand?

Robotics

Giovanni Campanella, Systems Manager, Texas Instruments

As robots are more and more a commonplace in factories it’s important that they become more intelligent, autonomous, safer and efficient. All of this is enabled with precise motor control, differentiated sensing technologies and processing at the edge, all with robust real-time communication. TI offers various technologies that enable modern robotic systems ranging from TI mm wave sensors for detecting obstacles around the robot to Sitara processors running AI at the edge with multiple high-speed peripherals that enhance the designs of industrial robots.

Mike Chen, Omron

Yes. Many manufacturers and businesses are intrigued by the idea of having robots help them improve productivity, but they often lack a full understanding of what constitutes a “robot.” For example, potential customers who are new to the technology view robotic technologies in a variety of ways – sometimes as full functional ready-to-work solutions that can do anything. There is of course more nuance to what can really be provided within their budget: a standalone product vs. a solution incorporating ancillary technology, custom written application-layer code vs. the just built-in firmware, possible integrated vision inspection or artificial intelligence, and so on.

Smart control solutions that integrate into packaging applications can boost manufacturing efficiency by enabling flexible and reconfigurable factory floors. (Image courtesy of Omron)

Retrofits

Todd Mason-Darnell, Ph.D., Marketing Manager-Services & Safety, Omron Automation Americas

With the changing demographics of the workforce, aging of the existing equipment install base across all industries and the general demand for factory automation, Omron is seeing not only a significant increase for functional safety retrofits on existing equipment but also an increase in the expectations of our customers for the level of technical sophistication for those safety solutions. With the older workers being replaced with younger workers, companies are looking to implement safety solutions to protect those less experienced workers. This, coupled with the increased expectations of newer generations of workers for a safer workplace, is driving the general demand for functional safety retrofits. However, companies are using the opportunity of a safety retrofit to implement more sophisticated safety solutions which in turn support their larger IoT/IIoT strategies. For example, previously, companies may have used a safety door switch and a safety relay to guard a hazard. Now, they are using a safety network controller in place of the basic safety relays. The addition of the safety network provides them the ability to integrate safety data from their equipment into a larger “big data” solution.

Electronics and biomedical

Jason Goerges, GM North America & Global VP of Marketing, ACS Motion

We have seen an increase in new opportunities for next generation semiconductor, FPD, and electronic assembly equipment driven by advances in automotive, mobile device, and cloud technology.

We have also seen opportunities for Biomedical equipment driven by advances in genome sequencing, imaging, and cell manipulation technology.

Across these diverse applications, we are seeing higher precision and throughput expectations from OEM machine builders for the motion control system.

What kinds of capabilities do your components incorporate to support functions related to the Internet of Things (IoT) or the Industrial IoT?

Thomas Leyrer, Systems Architect, Texas Instruments

For industrial IoT (IIoT) there are different requirements compared to networking in the broader consumer space. We differentiate two types of networks in IIoT. One is adding an information channel to get additional data for service and diagnostic. Such networks can be wireless or wired and requires network security. The diagnostic channel is typically asymmetric to the control communication and can use non-real-time communication protocols such as OPC UA.

The second type of network in IIoT is part of a real-time control system. Here, data exchange needs to be deterministic and real-time. The industry has developed real-time Ethernet protocols such as EtherCAT and Profinet for real-time communication and control systems. There is a new network layer called time-sensitive network which is supposed to handle both real-time deterministic communication of control data and asynchronous communication for service and diagnostic with quality of service.

In either of these networks for IIoT, the physical layer needs to conform to the industrial environment. Electromagnetic compatibility in industrial control systems such as robotics and PLCs need to withstand high levels of disturbance.

Todd Mason-Darnell, Ph.D., Marketing Manager-Services & Safety, Omron Automation Americas

In general, all of Omron’s newest safety components are created to support customer’s IoT/IIoT requirements. For example, our NX-SL5 line of safety controllers is the only safety controller on the market that can support CIP safety and safety over EtherCat (FoSE) on a single controller. Additionally, our newest family of light curtains, the F3GSRA, has I/O link capabilities that allows users to monitor the performance of the device to reduce troubleshooting and maintenance activities.

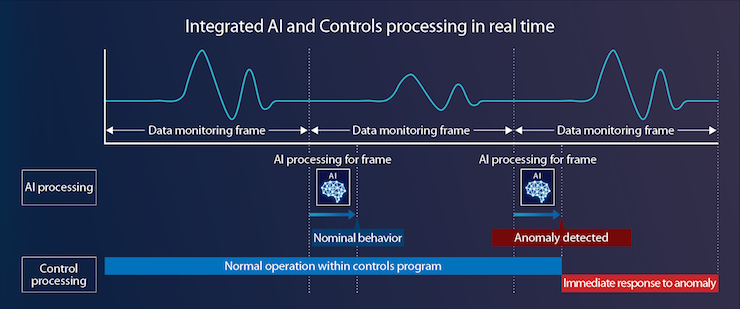

New computing technologies such as artificial intelligence (AI) are being incorporated into control processing to improve real-time response to system anomalies. (Image courtesy of Omron)

What value-add services have you provided to an OEM or other customer? Are there services that customers are specifically asking for?

Miro Adzan, General Manager, Texas Instruments

Our customers continue to require more and more system-level expertise from suppliers. Design engineers take advantage of our dedicated systems engineering team, which is organized by market sectors. Additionally, we offer system-level and deep technical knowledge focused on analog technologies and embedded processing products through technical documentation and helpful design tools on TI.com. For example, sub-system reference designs, including block diagrams, BOM, test results and Gerber files are shared with customers.

Todd Mason-Darnell, Ph.D., Marketing Manager-Services & Safety, Omron Automation Americas

Beyond engineering and installing safety solution retrofits to existing equipment, we are seeing an increased demand from both end-users and OEMs for Omron’s safe machine design consulting services. Rather than retrofitting a safety solution to equipments after they arrive from the OEM, most manufacturers are now requiring to have the safety solution integrated into the design of the machine. However, with the general trend toward more automation and larger and more complex equipment, most OEMS do not have the in-house capability to adequately evaluate and design a safety solution that meets the customer’s expectations or the current regulatory requirements. As a consequence, they are partnering with Omron for our safety engineering expertise to ensure their equipment is safe as delivered.

Jason Goerges, GM North America & Global VP of Marketing, ACS Motion

ACS provides training (ACS-specific and generic), application support, and application development services to our OEM customers. For OEMs interested in evaluating ACS capabilities, we offer application testing and conversion services. For select applications, ACS develops customized control algorithms that push the envelope of achievable motion performance.

Are you seeing much activity or interest in new trends in wireless connectivity and technologies for industrial applications and machine designs?

Miro Adzan, general manager, Texas Instruments

More and more IoT and IIoT systems are beginning to require wireless communication technologies. We offer a broad portfolio of RF-MCUs that support the main industry standards for RF communication including Wireless HART, wireless IO-Link, BLE and Wi-Fi. Several TI products are capable of supporting multi-channel and multi-wireless protocol implementation which enables customers to use one hardware platform for differing communication requirements – even dynamically switching between different wireless protocols within one application.

Todd Mason-Darnell, Ph.D., Marketing Manager-Services & Safety, Omron Automation Americas

Both bluetooth and I/O link are becoming huge for customers to monitor their individual safety components. Bluetooth is so ubiquitous in our daily lives, most customers just expect all components to have that capability. For diagnosis and routine monitoring, the ability to wirelessly connect to individual safety components via a phone or tablet is becoming a “maintenance multiplier” for most customers. Similar, the ability to gather data, I/O link, to a central hub has simplified those routine and daily activities in a plant.

Mike Chen, Omron

Yes, but much more interest than implementation. Wireless technology for communications between industrial devices has been a hopeful fascination from the automation industry for many years over multiple technological innovations. After the customer goes through detailed investigation, we find that many customers end up choosing what their companies can self-support with their maintenance teams if anything should go down and risk production.

The ECMsm from ACS Motion is a 2- or 4-axis motion controller with integrated drives supporting up to 3.3/10 A per axis and a 12 to 48 Vdc drive supply input. The compact footprint makes it suitable for small-format equipment in biomedical and semiconductor applications.

Jason Goerges, GM North America & Global VP of Marketing, ACS Motion

There are new applications involving wireless communication (host to controller), however the more significant trend we see is towards integration. For example, integrating the motion controller and drives into a single compact package becomes increasingly valuable when trying to minimize machine footprint. The soon to be released ECMsm, first in a series of new Economical Control Modules, was developed to address this need.

Tell us about any selector, sizing, or sales software you use or offer to customers and how these tools are changing how design engineering is done.

Mike Chen, Omron

Built-in simulation and emulation software has become critical in optimizing engineering time. When multiple hardware products are required to solve an application – with different lead times for each – the on-time completion of the project depends on how well the engineering team can use their time before the hardware arrives, and whether they can trust that their application code will work with the system hardware once it does arrive. Omron provides built-in simulation and emulation tools in our software to help our customers get a major head start in solving their applications or even in quoting their own customers before they need to invest in inventory.

Jason Goerges, GM North America & Global VP of Marketing, ACS Motion

ACS will release the new Smarter Motion Tools software package in Q2 2020. This software package was designed to streamline the process of defining and executing motion stage performance qualification and ATP, saving stage manufacturers and machine builders significant time and effort.

Filed Under: Factory automation, Motion Control Tips