Does the U.S. economy experience a gain or a loss when it sends manufacturing to China? Judge for yourself after you read the following dialog with William Sinn, President of Sinn & Company, an international consulting company, and an article submitted by Kurt H. Hartwig, Director of Marketing and Sales, Electronic Technologies, International.

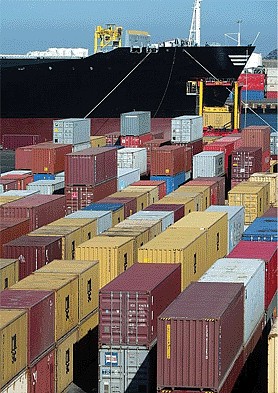

Editor’s note: Most companies outsource certain components, parts, and processes that are not among their core competencies. This procedure lets them become more cost effective and efficient. For example, outsourcing traditionally had been a matter of one company ordering printed circuit boards from another company in a neighboring city because it lacked the board processing facility. PC manufacturing was not its core business. However, making PC boards was all that the other company did, so everyone benefitted. But all that changed big time in the 1970s and 1980s when foreign outsourcing (offshoring) competition began eroding the U.S. manufacturers’ economic base, not necessarily because they made better machines and products, but because they had cheap labor. And it has gotten so far out of hand today that most U.S. companies manufacture virtually no products. In order to get some answers to a few niggling questions on my mind (real or imagined) about offshoring, I interviewed William Sinn, a business strategist and engineer who aligns U.S. firms with Chinese (and other country’s) manufacturing companies.

William Sinn

President

Sinn & Company, LLC

Cleveland, Ohio

JG. My perception is that offshoring takes jobs away from U.S. companies and U.S. employees. What do you observe?

WS. Companies have used outsourcing as a tactic for decades to strengthen their competitive advantage in a chosen marketplace. Offshoring is just another form of outsourcing with the exception that they purchase or manufacture products or components overseas. By offshoring, these companies are leveraging the comparative advantage of other nations.

For instance, China’s advantage is low cost and abundant labor. The U.S.’s advantage is creativity, technology, and marketing. Great companies use both of these advantages well. They not only gain market share in a competitive industry, but they also help grow the total market by innovation and introducing new products.

Now, to specifically address your concern about losing U.S. jobs, we have to consider two ways that companies outsource and offshore product manufacturing, one good and the other not so good. First, the good way: When a well-run company that has its own Marketing and Sales, Engineering, and Manufacturing Departments, considers offshoring, it is because the managers determined that they can save money by using China’s cheap labor. They expect that the company will become more profitable and their market share will grow as a result of the lower prices. In this case, I admit that some lower-end jobs, manual-labor jobs, might be lost within this company to these lower-cost countries–or even by automation within that company, for that matter. But the higher-end jobs, which are focused on innovation, design, and new products should increase as the company reinvests its larger profits. The final result, however, depends on how well this company develops proper long-term, successful strategies for its business.

The second method is not so good. This is the situation where a sales and marketing firm, a distributor, or a retail outlet, decides to go straight to China and eliminate the “middle man,” which is the U.S. manufacturing firm that normally supplies it with products. What happens here is that neither entity, the U.S. distributor/retailer or the Chinese manufacturer, has expertise or experience with the product design. So when a problem arises, nobody in that supply chain knows how to fix it.

Now, a corollary to this second scenario is the situation when a U.S. company with Marketing and Sales, Engineering, and Manufacturing departments decides to eliminate its Manufacturing and Engineering departments to “save money.” Yes, many good jobs are lost, and this is what you hear about in the popular media. They went from being a manufacturing company to a distributor with no intellectual property or expertise to solve product quality problems.

Economically, a successful domestic and offshore strategy will help a company prosper by both gaining market share and growing the market. A growth company will help the nation by creating better and higher-end jobs for its citizens.

JG. I have been told that when the engineers in China run into a problem, they often throw up their hands and quit. They are not good at follow-through. Consequently, the U.S. engineer has to go to China at great expense and time to get them out of trouble. How do you explain this?

WS. Much of our own engineering knowledge accumulates from numerous experiences in dealing with customers and understanding the market needs. Chinese engineers, although improving, still lack enough of this kind of experience. This situation is rooted in the Chinese educational system and 50 years under Communist rule when books were burnt and everyone went back to the farm.

Also, a serious weakness of Chinese engineers is their reluctance to ask questions. This has to do with the cultural myth of “lose face.” As a result, we see more misunderstanding and a lack of action.

As more experienced U.S. engineers, we need to better understand this situation and understand the engineers we work with. We need to go from being just an engineer to a coach, teacher, and manager. Frequent visits with Chinese counterparts are essential, and the associated costs needed to do this have to be considered as we develop our long term business strategy.

I have seen companies do this well. Their engineering capabilities and efficiencies have risen tremendously. For example, Chinese engineers have enabled U.S. engineers to perform more creative work than spend time on repetitive tasks such as drafting.

JG. Is it true that because the Chinese have no stake in the company they work for, they don’t particularly care about product quality?

WS. Today, in China’s shopping malls, one can buy a $1 shirt or a $100 shirt. If they buy a $1 shirt, they understand that the level of quality of this shirt may be low. As they cannot afford a higher priced shirt, they will tolerate the less-than-quality shirt.

As most Chinese employees do not have any idea of where their products are selling or how much they are selling for, they do not know if they are making a $1 shirt or a $100 shirt. That is why when we purchase products or components from China, we have to be diligent in doing quality control planning. A specific, simple, and measurable control plan is essential to be successful.

JG. How good or bad are the working conditions? Are the Chinese paid low wages and taken advantage of?

WS. China’s comparative advantage as a nation is low-cost labor. Companies know that if their wages are high, they will not be competitive in the world market. The China labor market is open. The workers will only work at a specific factory if they think their wages are competitive. That is why we see quite a bit of employee turnover in China. Of course, we look at China through American eyes. Their employees do not receive the same kind of treatment that we receive from our employers. If we look at China through Chinese eyes, a lot of workers and their families are better off working in industry than on a farm back home.

Labor will become more powerful as the nation develops. Minimum wage standards are enacted in China, safety standards are also being implemented, and social insurance is enforced.

By understanding China, and more importantly, the current phase of China’s development, we will become more successful in working with China.

JG. Chinese manufacturing firms do not appear to have uniform standards or environmental controls like the EPA here, so environmental pollution is great. What’s worse, they don’t have FDA. What are they doing about it?

WS. The U.S. has a highly regulated economy. A lot of the rules and regulations imposed by EPA, FDA, and others are developed over time, especially during the past 50 to 100 years. China is an old country, but this kind of regulation has only been enacted during the past 20 years.

As I observe, China has some good, basic regulations in safety and pollution. However, enforcement is a challenge for them. If they immediately enforce a U.S.-type regulation, they will not have the knowledge or the equipment to comply. That is why a gradual approach is necessary.

Most successful U.S. companies operating in China also help their subsidiaries develop a “China Green” strategy. This will also set an example for the Chinese companies and create a critical mass to better implement environmental and safety controls in China.

JG. They don’t seem to follow the U.S. manufacturers’ product specifications. For example, they have used lead paint on children’s’ toys and toxic chemicals in foodstuff. Why?

WS. Almost all the paint that the Chinese use is lead based, similar to what we used 50 years ago. When we purchase goods from China, we have to spend the time to understand their capabilities and constraints. We cannot take it for granted.

But we will always find greedy people in an emerging economy. They understand the benefits of money and will do anything to acquire it. This is difficult for all of us. We have to develop deep quality control plans to prevent such problems.

JG. When a U.S. company needs to have a new product quickly, one engineer told me that the Chinese company cannot respond fast enough. What is the problem?

WS. Most Chinese marketing and engineering staffs do not understand our needs thoroughly enough, especially our market needs. In addition to language, that is, a multiple translation problem, that will make introducing a new product with China very challenging. My philosophy is to avoid developing a new product with a new Chinese company. Both of us will be frustrated. Rather, start a new product development program with a company that has established a good record.

JG. When a company needs a short production run, China cannot seem do it. Is it true that they produce only in large quantities?

WS. The solution is matching the right Chinese company with our needs. China started its industrializing journey with toys, shoes, and garment-type products that were highly labor

intensive. All of these products are also high volume in nature. Therefore, most of these Chinese companies are set up for high production-run manufacturing.

In addition, unless there is much business between the U.S. and Chinese companies, the Chinese company understands that the profit potential for short-run products is probably limited. The cost of communicating and development is high. That may be another reason that the Chinese often refrain from doing short-run manufacturing.

If our product category tends to be high sku and low volume, I would encourage us to study its true total cost before making a decision to manufacture in China. Often, our customers’ and our costs are better served when manufactured domestically.

JG. I was told that the Chinese are not skilled at designing and making molds. Is this true?

WS. Mold making actually has become one of China’s competitive strengths. Today, most of the plastic injection molds and casting dies are made in China. It is not because Chinese engineers are more skilled in mold making; it is because of the CAD/CAM revolution; now the computer has taken over the job of the tradesman.

In addition, because labor is cheap in China, obtaining the skill to improve the productivity and efficiency of molds has not been a priority to the Chinese. For example, they do not have the same incentive as U.S. manufacturers to make a mold with multiple cavities; it increases capital costs. The Chinese can just use more people. In the U.S. we try to use fewer people because of cost. Again, if we can combine our experience with the Chinese labor, we can help both our companies and our

nation grow.

JG. Chinese companies cannot add value to the product or process, nor suggest manufacturing improvements as the parts or products are being made. Why not?

WS. It is hard to add value to a product when they do not understand the application well and are not close to the customer. Because labor is already cheap, they have little incentive or need to

improve process efficiency. In other words, lean manufacturing is a more difficult process to implement in China than in U.S. But this will also be a learning process for the Chinese. As labor cost increases and they become more familiar with the market, we will see drastic improvements in this area.

JG. I think outsourcing or offshoring based on price alone invites the possibility of suffering great loss. Aren’t there hidden costs in such areas as cultural and political differences, warranties, and privacy issues, for example that have to be considered?

WS. Our decision to offshore to any source should not be based on cost alone, especially apparent cost. We need to understand the total cost and to understand its strategic impact on our

company. In my opinion, off shoring should be more of a strategic decision than a cost decision.

JG. There seems to be a time-to- market issue. I have been told that it often takes too long to bring China up to speed on a new product idea. How true is that?

WS. It is challenging enough for us to develop a new product and to implement it in a U.S. facility. Until we have developed a good process and have the right people in the U.S. and China, it will be challenging to work with China on a new product idea. But if we can accomplish the above goals with people and process, I believe it will be extremely efficient to develop a whole new product together, using our creativity and their labor.

JG. Intellectual property is always an issue. They are known to copy your product, make it on their own, and sell it to other countries. Is that ethical or even legal?

WS. The Chinese increase their knowledge and improve their skills by learning from us and copying us. We are the eyes and ears of their outside world. So, copying is a very natural instinct and the least expensive way for them to improve.

Legally, technically, and logistically we need to protect our life blood IP and know-how. A

successful, great company protects its IP by continually improving its products and processes. Its competitors are always at least one step behind the latest technology. Everyone, including the consumers, benefit from this scenario.

JG. I suspect they have no loyalty to the US manufacturer, and this could affect short term quality of the products they produce and long term relationships. What do you think?

WS. Loyalty comes from trust. If we develop their trust, loyalty will come. However, their basic need is their family’s financial well being and securing a better future. If they find a better paying job, they may go for it. We should not confuse loyalty with survival.

William Sinn is a business strategist and engineer who has been a practitioner in the international arena for more than 25 years.

He has resided and ran companies in both China and the U.S., and because he understands both cultures and business practices, he helps companies use China as a purchasing resource,

manufacturing base, and a marketing destination.

www.sinn-co.com

[email protected]

Let’s keep outsourcing in the United States

It’s faster, easier, and cheaper to do business with a company that is just around the corner than one located half-way around the globe. Outsourcing is necessary, but let’s keep it at home.

By Kurt H. Hartwig

Director of Marketing and Sales

Electronic Technologies International

Fort Atkinson, Wis.

As our economy evolves into a more global and competitive marketplace, outsourcing is increasingly becoming a necessity rather than an option. The extreme competitive nature of some price-sensitive products forces a company to continually search for cost-reducing, efficiency-enhancing strategies. And outsourcing a subassembly or a single part in the United States, rather than overseas, has several major benefits.

The first benefit is realized when a company strengthens and markets its core competencies to support the economies of scale theory. This increases efficiencies because, most often, the

domestic supplier has a vested interest in the OEM’s business model, not just delivering a final part or subassembly. For example, the supplier may have a diverse set of value-added services that can be tailored and customized such as engineering design and layout, prototyping, software development, marketing support, and material selection. Additional services may include financing strategies, idea generation, packaging design, product upgrades, referral networks, intellectual resources, stocking programs, legal affiliations, and logistics support.

Outsourcing to another county, however, impedes and diminishes this ideal because typically, the foreign supplier is known only for moving large-volume orders out the door. This means that some suppliers will have little interest in supporting the OEM on core competencies.

The second major benefit of outsourcing in the United States is reduced costs. As any business professional might expect, there are additional costs associated with outsourcing overseas. For instance, outsourcing to an overseas supplier based on price alone is risky because there are hidden costs that relate to cultural interferences, interpretation hindrances, time-zone constraints, political differences, proximity delays, and privacy and piracy issues. Additional drawbacks include handling and delivery damages, warranty claims, engineering changes, quality obstacles, lead-time concerns, and the learning curve theory.

Outsourcing to a supplier in the United States drastically reduces these cost-producing, efficiency-draining issues. In fact, it’s so easy for an OEM and a supplier to join forces that it’s common to conduct and complete business the same day.

A third major benefit is twofold: speed-to-market and product lifecycle extensions. With some products, time-to-market is a core competency for many U.S. based companies. Hypothecally, if I had an idea yesterday for a new product, it’s realistic to locate a supplier in the U.S. who would begin the design work today. Try to do that in China, India, or Japan without time-zone constraints and language barriers. U.S.-based suppliers have the flexibility and responsiveness, not only to bring products to market faster, but also to assist OEM’s in product lifecycle extensions. For example, in the U.S., the smallest change in design or upgrade can be implemented in a matter of hours, where, on the other hand, it could become extremely costly working with an overseas supplier because of delays and the distance.

OEM’s should be encouraged to conduct business with suppliers in the U.S. rather than overseas because of the numerous benefits discussed above. Do not let price alone drive the decision making process. Forming a partnership with a domestic supplier is an opportunity for an OEM to strengthen and leverage its business model by acquiring new core competencies. U.S. based suppliers have value-added services that are offered before and after the sale. They also have a strong loyalty that an OEM may never find overseas; the slogan “Made in the USA” shines with great pride. With this in mind, there is every reason to retain outsourcing in the United States.

Hartwig recieved his BPA and MBA degrees from Concordia University Wisconsin. His career experiences have been in manufacturing comapnies for more than 17 years, starting in skilled trades and moving into marketing and sales.

Filed Under: Commentaries • insights • Technical thinking

Tell Us What You Think!