Credit: IHS Markit

Revenue in the mobile infrastructure market dipped 11 percent year over year in the third quarter, setting 2016 up to be the first year of decline for 2G, 3G, and 4G macrocell deployments, IHS Markit said.

According to IHS Markit data, global macrocell mobile infrastructure revenue in the third quarter fell to just $10 billion in a drop the firm said confirms “we have entered the post-Long Term Evolution (LTE) peak era.”

Despite activity in China, Japan, and North America, IHS Markit said the market actually declined 4 percent on a sequential basis in those regions.

By technology, IHS Markit noted the 2G and 3G segment was down 11 percent sequentially and 20 percent year over year, even in the face of a boost from WCDMA in Japan. The firm said LTE was “somewhat a bright spot” in the latest quarter, up 1 percent sequentially but down 3 percent year over year.

On a vendor basis, the report said Huawei edged out former leader Ericsson for the top slot in macro 2G/3G/LTE radio overall. Ericsson is now in second, followed by Nokia in a close third. On LTE alone, though, IHS Markit said Nokia is in first place, with 34 percent of the market share.

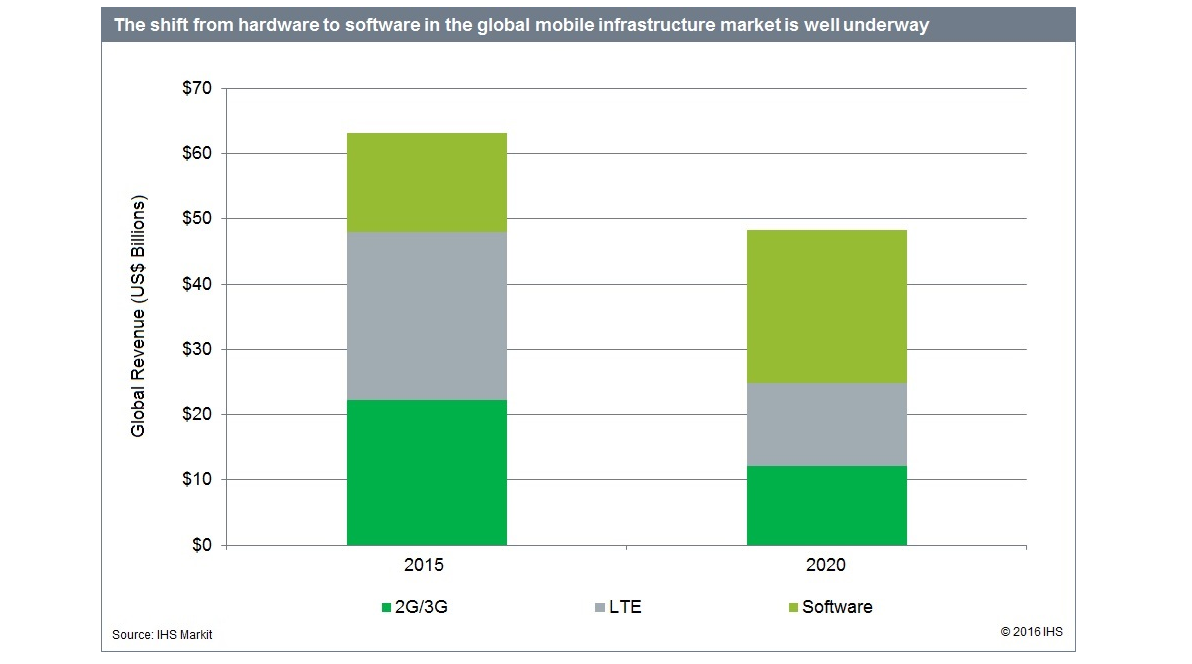

Where hardware is down, software is up, the report said.

Global software revenue grew 17 percent year over year in 2015 to more than $15.2 billion, driven primarily by LTE-Advanced upgrades. Through 2020, IHS Markit said that segment is expected to grow at a compound annual growth rate (CAGR) of 9 percent to hit more than $23 billion in revenue.

“The transition to software is happening, and software will sustain the entire mobile equipment market until 5G kicks in, creating an inflection point and bringing some much-needed growth—though moderate at best,” IHS Market said.

Filed Under: Infrastructure