A new report from the Telecommunications Industry Association (TIA) has pinpointed a lack of diversity in 5G network densification, disparate data offload strategies, and uncertainties around backhaul technology as three of the top challenges operators must overcome for early 5G deployments.

TIA’s report indicated nearly a third of respondents have already begun 5G technology trials, with an additional 26 percent planning to conduct 5G trials over the next two years. More than two-thirds of respondents said they plan to conduct radio technology trials first rather than network technology trials. And nearly a third – including operators in Australia, China, Japan, Korea, and the United States – said they’re looking to launch pre-standard 5G products.

But the survey also revealed some potential hurdles operators might face in deploying 5G.

While most survey respondents said they were planning to partner with building owners, electrical utilities, and public lighting companies for network densification efforts, TIA noted fewer than 40 percent of respondents identified other potential partners. This lack of broader partnership strategies, TIA noted, could come back to bite operators down the line.

The survey also revealed unlicensed is a shoo-in for traffic offload, but indicated a variety of strategies will be used. According to the report, 79 percent of operators plan to use WiFi, and 55 percent specified they’ll use Licensed Assisted Access (LAA). Around 41 percent favored LTE/WiFi integration as well as LTE WiFi aggregation, while 4 percent were interested in fully unlicensed technology like MulteFire. The wide array of unlicensed strategies, the report suggests, indicates complex radio environments will be inevitable.

And finally, while the report noted fiber backhaul was overwhelmingly preferred by survey respondents (100 percent said it was either important or very important), point-to-point millimeter wave was also identified by 61 percent of respondents as important or very important for 5G backhaul. Around 42 percent of respondents also indicated point-to-point microwave will be either important or very important in a 5G world. Though the report acknowledged fiber is ideal for backhaul, it also noted laying it can be expensive. Thus, the industry may have to do more work to address operational challenges in millimeter wave backhaul to compensate.

Credit: TIA

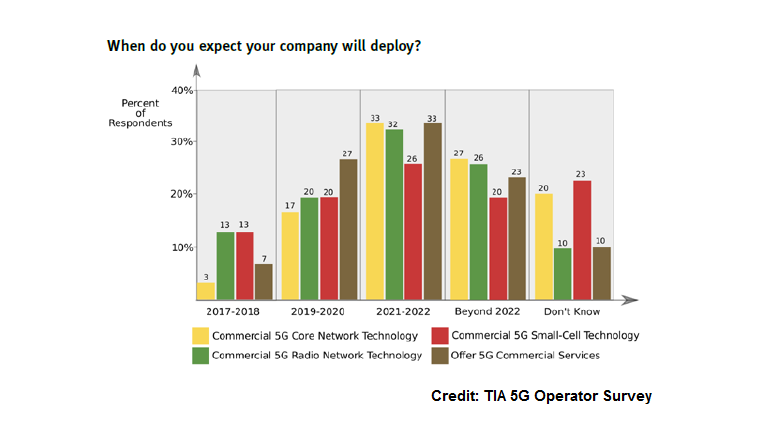

Other pertinent stats from the report include the fact that 17 percent of operators said they plan to make 5G investments as part of CapEx this year and next, while 30 percent each said they would be making investments in the 2019-2020 and 2021-2022 timeframes. More than half (53 percent) said the radio network would be the first 5G domain installed, followed by 27 percent who pointed to the core network, and 17 percent who said they’re looking at a combination of the two. For radio deployments, more than a third (35.5 percent) said they will initially focus on both sub-6 GHz and centimeter and millimeter wave frequencies. Just 16 percent said they will focus on sub-6 GHz only and under a quarter (22.6 percent) said they’ll focus only on centimeter and millimeter wave. A quarter of respondents said they haven’t yet determined what bands they’ll use.

TIA’s survey was conducted by Tolaga Research and sponsored by InterDigital, and included responses from 31 qualified network operator executives across Europe, North America, Asia and Oceania, Latin America, and Africa. Approximately 90 percent of respondents were director level or above.

The full report can be found here.

Filed Under: Wireless • 5G and more, Infrastructure